Richard Serlin: In Theory (but Not in Practice) the Minnows Counter the Whale to Yield Wallace Neutrality

Wallace Neutrality says that in theory, quantitative easing (QE) should do almost nothing. (See “Wallace Neutrality Roundup: QE May Work in Practice, But Can It Work in Theory?”) In the Twitter discussion I storified as “Noah Smith, Brad DeLong and Miles Kimball on Wallace Neutrality,” Noah raised a question of how Wallace Neutrality works. Richard Serlin, who has made himself one of the world’s experts on Neil Wallace’s original paper, was good enough to agree to write a guest post giving his answer:

Miles kindly asked me to comment on the recent Twitter discussion he had with Berkeley economist Brad DeLong and Stony Brook economist Noah Smith on Wallace neutrality. He was specifically concerned with how I would answer this question which comes up in the discussion: Does Wallace neutrality result from (in theory) fiscal policy canceling out the Fed, or many private agents (the minnows) canceling out the Fed (the whale)?

My answer is that in the Wallace model it is the minnows (agents, investors, people) all working to completely undo what the whale (the government) does.

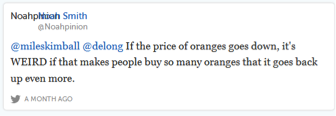

Some specifics from the tweets:

Sumner Critique: Monetary reaction cancels out fiscal policy. Wallace Neutrality: Fiscal reaction cancels out monetary policy. Hmm…

— Noah Smith (@Noahpinion) August 8, 2014

I won’t get into the Sumner part, but, like Miles, I think the Wallace neutrality part is wrong. If you look at the irrelevance proposition on page 270 of the AER paper, it holds even if taxes and transfers (w(t)) are unchanged; you are allowed to select that option in the proposition, which is proven to hold. And, government consumption is required to be unchanged. Moreover, the choice of taxes and transfers is, in any case, restricted to not be any different in net present value, based on the original state prices, by the condition (a).

This really doesn’t even happen. It’s, the government starts printing money and buying more oranges, and storing them until next period, when it will sell all these extra oranges back again. All agents know this, and they immediately sell an equal amount out of their stores because they know they won’t need as many next period with the government storing more and planning to sell them next period. So, the price never moves. People in this model are all superhumans. They have perfect foresight, expertise, and optimization, and act instantly.

@Noahpinion@delong It only works in theory, not in practice. I love Brad’s “Washington Super-Whale” analogy: http://t.co/wFgE6LiQlN

— Miles Kimball (@mileskimball) August 9, 2014

I think one big difference here with the world of Wallace’s model is that in Brad’s story the hedge fund managers could not be that sure what the whale would do in the future. In Wallace’s model they know precisely, and with 100% certainty, what Bernanke (the government) will do at every point in the future. They can trade with confidence and hold the line. By contrast, the hedge fund managers in Brad’s story got hurt badly because they did not, in fact, predict well how Bernanke (the government) would behave.

Basically, I discussed this in my recent post on Wallace neutrality, The Intuition behind Wallace Neutrality, Attempt 3.

In Wallace’s model, the government is like a big MM firm. And the citizens are shareholders of the government. When the government does the Wallace version of a QE, it basically is like it borrows more money (really lends, but let’s look at the converse for now). That makes its citizens overall debt level higher than they like, so they borrow less by an equal amount to get back to their optimal overall debt level. The total demand for debt in the market remains unchanged. Government demand goes up by X, and private demand goes down by X, so the interest rate remains the same…

But why wouldn’t this work in the real world?

Well, first off, people are far from perfectly expert (especially in the super complex modern world), with perfect public information that they can gather, digest, and analyze at zero time, effort, or money cost…

So, when the government “firm” starts to lend a lot more, almost no one thinks, MM style, or Wallace style, I’m going to start selling some of my bonds to compensate in equal measure as I see them doing that. And so total lending in the market does, in fact, go up, and market interest rates drop. People just don’t react that way. And it won’t be nearly enough if a savvy minority do. They won’t control enough money to drive us to Wallace neutrality.

It’s like in Miller and Modigliani’s model if the firms start borrowing a lot more, but the shareholders are mostly not really paying attention, and/or don’t know well the implications, so for the most part they don’t borrow any less to compensate. In that case, aggregate demand for borrowing would not remain unchanged. The aggregate demand curve for borrowing would, in fact, shift out, and the interest rate would rise.

Other issues: In the real world there are a lot more different kinds of financial assets than just money, and borrowing and lending the single consumption good risk-free, like in Wallace’s model. So, if the government does QE in just some types of assets, people, even if they are perfect at optimizing, won’t be able to funge their portfolios to relieve completely price pressure on those assets. Markets are not complete, and far from it, so that you could construct a synthetic for any asset. I talk about this in an earlier post on Wallace neutrality when I ask “What if the government did a QE intervention where they printed up dollars and used them to purchase 100 million ounces of gold?”

Next, Miller-Modigliani irrelevance doesn’t hold if investors face different borrowing costs and liquidity constraints than the firm. Likewise, Wallace irrelevance will not hold if individuals and firms face different borrowing costs and liquidity constraints than the federal government. Do they?

Finally, Wallace’s model assumes that with 100% certainty the central bank will completely reverse the QE one period later, and everyone knows this…In the real world, investors cannot be completely certain a QE will be 100% reversed in the future.

And empirically we see Wallace neutrality not holding. UCLA economist Roger Farmer recently wrote, “A wealth of evidence shows not just that quantitative easing matters, but also that qualitative easing matters. (see for example Krishnamurthy and Vissing-Jorgensen, Hamilton and Wu, Gagnon et al). In other words, QE works in practice but not in theory. Perhaps its time to jettison the theory.”