Haozhao Zhang: The US Should Counter Russia's Natural Gas Weapon With Its Own

Image from the New York Daily News article “Vladimir Putin approves draft bill for annexation of Crimea as Russia, slams U.S. opposition.”

Haozhao Zhang is a student in my “Monetary and Financial Theory” class at the University of Michigan. I very much liked this post he did for the internal class blog. I asked him if I could make it a guest post here:

The current conflict in Ukraine is attracting a lot attention. Weeks ago, in order to against the counter force from EU countries, Mr. Putin played his trump card: raise the natural gas price in Ukraine. As a big country rich in natural resources–especially energy–Russia can use its control over the natural gas piped into Europe from Russia as a strategic weapon in this game.

The West has threatened to sanction Russia for moving to annex Crimea. But more than 30% of gas in EU is provided by Russia, so the credibility of those threats is in doubt. Leading countries in the EU such as the UK and Germany are faced with such a concern: the graph below from NYT can shows that major buyers of the Gazprom – Russia’s largest state-owned natural gas company.

Note the positions of Germany and Britain on the list. Actually according to this article in WSJ, Six countries in Europe import 100% of their gas from Russia, and an additional seven rely on it for at least half. It is beyond doubt that Russia has its considerable influence on the attitudes of the EU countries on this affair. U.K. Foreign Secretary William Hague said European nations may need to “recast their approach” to Russian energy purchases if the crisis isn’t resolved.

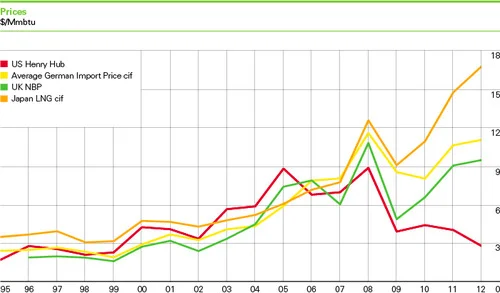

Also reported in WSJ, Obama’s government is taking measures to curb the Russia’s stranglehold over EU’s natural gas supply. US is currently one of the biggest natural gas production nations in the world due to one of its most advancing tech in this field: fracking. The strategy is to increase natural gas exports to the EU from the US, reducing the EU’s dependence on Russian gas. Compared to Russia, US has a big initial cost advantage that can help balance out transportation costs. As the graph from BP’s official site showed below, the natural gas price has kept falling over recent years in North America. The price in US is far lower than that of Asia and Europe.

In this strategy for the US, big oil and gas production firms like ExxonMobil benefit a lot from it, while environmentalists and small manufacturing companies strongly oppose such a claim. From a geopolitical point of view, this strategy seems unstoppable.

There are several reasons why US has restricted oil and natural gas exports in the past:

- Exporting more natural gas will increase the price of it in the US. Currently the natural gas price in US is only about 1/5 of that in Japan, which gives an advantage to US manufacturing industries that rely heavily on gas as raw material. More exports would mean less gas available in US, and the price would likely rise.

- Environmentalists are concerned about fracking.

- Fear of running out: in the past, with less advanced technology the available gas reserves seemed limited. People were afraid of a natural gas shortage later on if it was exported now.

However, the current situation is dramatically different. Here is why it is now a good time for the US to export natural gas:

- There is a boom in natural gas reserves, thanks to the new technology of “fracking.“

- Increasing the domestic gas price now looks like a good thing. Because of the increase in gas reserves, natural gas producing firms are complaining. Exports would now raise the price and benefit those firms without making the prices seem too high to consumers, compared to what they were used to in the past.

- Exporting US natural gas would curb Russia’s power over the EU. The political pressure in the Ukraine will be the main push behind increasing natural gas exports from the US.

Overall, the US strategy is good news, because it can help establish a global natural gas market, and encourage the use of relatively clean, low-carbon natural gas.