What to Do About a House Price Boom

Matthew Yglesias asks in his post today what a country is supposed to do about a housing boom:

Ever since American house prices started declining, people who predicted that this would happen have been crowing and slagging policy elites who failed to see it coming. I think in some ways the better question is what are you supposed to do about these situations?

He goes on to point out that this is a relevant question for Norway and Canada now:

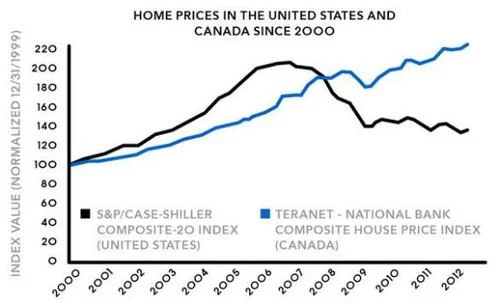

Right now everyone seems to agree that Norway is experiencing an unsustainable house price boom. You may have recently heard the factoid that Canadian household wealth is now higher than U.S. household wealth, but this too certainly looks like an unsustainable house price boom.

I don’t know enough about Norwegian and Canadian institutions to have a well-informed answer for them (though I hope what I say will be useful), but with the benefit of a time machine, there are three good answers for the United States.

First, the mortgage interest deduction is unfortunate in any case, since it tilts people toward borrowing over saving. What may be worse, it tilts our economy towards building more houses and fewer factories, when we should be tilting things the other way. Almost all of the benefit of a house goes to the owner. By contrast, a factory not only benefits its owner with a stream of rentals on that factory (often called profits), but also employs people which benefits those workers in a way not captured by the owner of the factory. So if there were equal tax treatment of factories and houses, there would still be too few factories. The mortgage interest deduction skews the balance further in the direction of houses, soaking up some of the construction resources that could otherwise have gone to building factories that employ people not only in the process of being built but even after they are built.

So the mortgage interest deduction is unfortunate. But a time like now when falling house prices continue to drag our economy down is not a good time to lower house prices further by phasing out the mortgage interest deduction. On the other hand, a boom in house prices provides a golden opportunity to reduce the mortgage interest deduction, especially if you catch the boom early, so that stopping it doesn’t result in a big crash.

Second,if we could go back in time and do things right, surely we would restrict low-downpayment mortgage loans as a way of reining in booming house prices and minimizing the likely damage in any subsequent period of declining house prices.

Third, if we could go back in time and do things right, I hope we would adopt regulations to encourage risk sharing in home prices, as recommended by Andrew Caplin here and by Robert Shiller in his new book Finance and the Good Society. A big reason for our current troubles is that homeowners bore the full brunt of the declines in house prices, up to the point of foreclosure. With risk sharing, other investors would take some of these losses, and of course to make that worth their while, they have to know they will share in some of the gains when house prices go up, or be paid some sort of insurance premium. The government can help. Currently, IRS regulations effectively discourage home price risk sharing contracts of the sort that Andrew Caplin recommends. And the kind of adjustment of the principal of mortgages according to what happens to home price indexes that Robert Shiller recommends (and indeed, helped start the Case-Shiller home price index in order to someday make possible), would be a big change in the customs of the real estate markets that could be speeded along greatly by regulations that encouraged such provisions.

In short, there are many things worth doing if one sees a house price bubble starting up. And the encouragement of risk-sharing in house prices is not just something we should have done, it is something that the U.S. should be working on now, to prevent problems in the future. There is no law of nature that says that homeowners need to suffer from regional or even national house price declines any more than people whose houses burn down should be left without a house or a family whose breadwinner dies should be left financially bereft. This is avoidable suffering. We should have insurance for house prices just as we have fire insurance and life insurance. And though private industry can handle house price insurance just fine once house price insurance gets going (with the same kind of government oversight we have for other types of insurance), we’ll get house price insurance a lot sooner if the government lends an extra hand at the beginning.