Travis Bradberry: 10 Habits All Genuinely Confident People Share

My lack of full confidence is shown by my urge to compare myself against Travis Bradberry's list of the habits of genuinely confident people. These six I do OK on:

- They speak with certainty

- They seek out small victories

- They exercise

- They take risks

- They aren’t afraid to be wrong

- They celebrate other people’s successes

But my insecurities show up in trying to impress other people. I don't let that get in the way of being my own person. (It would be quite hard for me psychologically not to be my own person even if I tried.) But I definitely

- Care about what others think of me

- Worry about whether I measure up

- Seek attention

- Talk too much

On talking too much, I have noticed that in addition to a high intercept on talking, I have an anomalously small negative elasticity of talking with respect to group size. Thus, the bigger the group, the higher the ratio of how much I talk compared to 1/n. I get the closest to talking a reasonable fraction of the time when I am talking to just one other person.

They say confession is good for the soul. We'll see.

Mitch Prinstein on Status and Likability

"You can have both. In fact, about 30 percent of those who are high-in-status are also really, really likeable. ... But ... one of the key ways to get status is to be aggressive. And that is the number one predictor of being disliked. Many people get their status by stepping on others and making themselves seem more powerful or important or worthy of attention than others. In doing so, they actually make themselves quite dislikable."

—MItch Prinstein, in an interview with Dave Nussbaum about his book "Popular: The Power of Likability in a Status-Obsessed World"

Meat Is Amazingly Nutritious—But Is It Amazingly Nutritious for Cancer Cells, Too?

The idea that red meat is unhealthy has been drilled into the American public for at least half a century. For those of us who have high standards for causal inference throughout the causal chain all the way from eating meat to death or morbidity, there is surprisingly little evidence for this view, though I will talk about some. How well the Inuit and Masai fared on a traditional diet of meat should give one pause in asserting too strongly the harms of red meat.

Let me give two bits of evidence, one positive for meat, suggesting it is very nutritious for the human body; another negative, suggesting it is highly nutritious for cancer cells as well.

First, let's turn to meat being very nutritious for the human body. In Chapter 19 of his excellent history of nutritional thought, "Good Calories, Bad Calories: Fats, Carbs, and the Controversial Science of Diet and Health," Gary Taubes tells about an early 20th Century scientific dispute over whether meat is enough to keep someone alive and in robust health:

The notion of a carbohydrate-restricted diet based exclusively on fatty meat was publicized after World War I by the Harvard anthropologist-turned-Arctic-explorer Vilhjalmur Stefansson, who was concerned with the overall healthfulness of the diet, rather than its potential for weight loss. Stefansson had spent a decade eating nothing but meat among the Inuit of northern Canada and Alaska. The Inuit, he insisted, as well as the visiting explorers and traders who lived on this diet, were among the healthiest if not the most vigorous populations imaginable.

Among the tribes with whom Stefansson lived and traveled, the diet was primarily caribou meat, “with perhaps 30 percent fish, 10 percent seal meat, and 5 or 10 percent made up of polar bear, rabbits, birds and eggs.”

The Inuit considered vegetables and fruit “not proper human food,” Stefansson wrote, but they occasionally ate the roots of the knotweed plant in times of dire necessity. The Inuit paid little attention to the plants in their environment “because they added nothing to their food supply,” noted the Canadian anthropologist Diamond Jenness, who spent the years 1914–16 living in the Coronation Gulf region of Canada’s Arctic coast. Jenness described their typical diet during one three-month stretch as “no fruit, no vegetables; morning and night nothing but seal meat washed down with ice-cold water or hot broth.” (The ability to thrive on such a vegetable-and fruit-free diet was also noted by the lawyer and abolitionist Richard Henry Dana, Jr., in his 1840 memoirs of life on a sailing ship, Two Years Before the Mast. For sixteen months, Dana wrote, “we lived upon almost nothing but fresh beef; fried beefsteaks, three times a day…[in] perfect health, and without ailings and failings.” ...

... If the Inuit thrived in the harshest of environments without eating carbohydrates and whatever nutrients exist in fruits and vegetables, they, by definition, were consuming a balanced, healthy diet. If they did so solely because they had become evolutionarily adapted to such a diet, which was a typical rejoinder to Stefansson’s argument, then how can one explain those traders and explorers, like Stefansson himself and the members of his expeditions, who also lived happily and healthfully for years at a time on this diet?

Nutritionists of the era assumed that all-meat diets were unhealthy because (1) excessive meat consumption was alleged to raise blood pressure and cause gout; (2) the monotony of eating only meat—or any other single food—was said to induce a physical sense of revulsion; (3) the absence of fresh fruit and vegetables in these diets would cause scurvy and other deficiency diseases, and (4) protein-rich diets were thought to induce chronic kidney damage, a belief based largely on early research by Louis Newburgh.

The nutritionists back then were Vilhjalmur Stefansson's opponents in this scientific dispute:

... Francis Benedict, as Stefansson told it, claimed that it was “easier to believe” that Stefansson and all the various members of his expeditions “were lying, than to concede that [they] had remained in good health for several years on an exclusive meat regimen.”

In the winter of 1928, Stefansson and Karsten Anderson, a thirty-eight-year-old Danish explorer, became the subjects in a yearlong experiment that was intended to settle the meat-diet controversy. The experiment was planned and supervised by a committee of a dozen respected nutritionists, anthropologists, and physicians.*

Eugene Du Bois and ten of his colleagues from Cornell and the Russell Sage Institute of Pathology would oversee the day-to-day details of the experiment.

... they began living exclusively on meat, at which point they moved into Bellevue Hospital in New York and were put under twenty-four-hour observation. Stefansson remained at Bellevue for three weeks, Anderson for thirteen weeks. After they were released, they continued to eat only meat for the remainder of one year. If they cheated on the diet, according to Du Bois, the experimenters would know it from regular examinations of Stefansson’s and Anderson’s urine. “In every individual specimen of urine which was tested during the intervals when they were living at home,” Du Bois wrote, “acetone [ketone] bodies were present in amounts so constant that fluctuations in the carbohydrate intake were practically ruled out.”

Du Bois was convinced:

Du Bois, who supervised the experiments, wrote an introduction to Stefansson’s book. After Stefansson and Anderson were living exclusively on meat, he said, “a great many dire predictions and brilliant theories faded into nothingness.” A diet that should have left Stefansson and Anderson deathly ill from scurvy had left them as healthy as or healthier than the balanced diet they had been eating in the years immediately preceding the study. “Quite evidently we must revise some of our text book statements,” Du Bois concluded.

To me, the most surprising thing was that no vitamin deficiencies resulted. Gary Taubes explains:

meat has a full set of amino acids;

meat has all the vitamins except vitamin C; and

the need for vitamin C is much lower when eating meat than when eating a lot of carbs.

There are arguments over whether our distant ancestors, in the environment of evolutionary adaptation ate mostly plants or mostly meat. I suspect that the recurrent ice ages back then made things tough enough that for us to be here today, our distant ancestors had to do OK on a wide variety of different diets. Sometimes, very little meat would have been available. At other times, meat might have been almost all that was available. I don't think it strange that we should be adapted to do well as almost total carnivores, even though we also have the capability to deal well with plant food in its natural form.

Now, to rain on the parade of pro-meat ideas above, let me turn to some interesting evidence suggesting that meat is very nutritious for cancer cells as well. The evidence comes from research by T. Colin Campbell and coauthors, recounted in his book, "The China Study: Revised and Expanded Edition: The Most Comprehensive Study of Nutrition Ever Conducted and the Startling Implications for Diet, Weight Loss, and Long-Term Health."

Link to the Wikipedia page for "The China Study"

Colin Campbell's team predisposed mice and rats to cancer by a range of methods, such as dosing them with aflatoxin and breeding them with genes making them prone to cancer. When these mice and rats predisposed to cancer were fed low-casein diets they usually didn't develop cancer. When they were fed high-casein diets, they usually did develop cancer.

Casein is a protein found in abundance in milk and cheese. Like other proteins from animal sources, it is a "complete protein" with the full range of amino acids needed to build mouse, rat or human cells. My hypothesis for what was going on in the experiments is that if there is a superabundance of complete protein available, it makes it easy for cancer cells to grab some of that protein or the complete set of amino acids from that protein to build strong cancer cells. In other words, my hypothesis for the results Colin Campbell's team got is that a diet low in complete protein is like a very safe form of chemotherapy: having low levels of complete protein is harder on cancer cells than it is on normal cells that don't need the materials for growth as much.

A straightforward way to have low levels of complete sets of amino acids, and thereby inhibit the development of any incipient cancers one might have, is to eat relatively little animal protein and to not have too much in the way of complete combinations of proteins for plant proteins beyond that. If you have had a cancer already been detected, it is probably worth talking with one's doctor about cutting down complete protein even further.

I wonder if eating plant proteins in a way that is complete over time, but incomplete on any one day, could hit the sweet spot of providing enough of all the essential amino acids for the normal cells to do their thing, while still making it hard for cancer cells to get all the key amino acids they need to grow quickly.

In addition to the experimental evidence in mice and rats, Colin Campbell and his coauthors have a monograph Diet, Lifestyle and Mortality in China: A Study of the Characteristics of 65 Chinese Counties that provides 65 very interesting data points with rates of incidence for many different types of cancer and other diseases, together with dietary patterns for a county based on samples of individuals from two villages in each county. Because this data was collected relatively soon after the opening of China after the death of Mao, diets in China had not yet Westernized when the data was collected, and were different in different counties. Though it is hard to separate out different possible explanations with only 65 data points, animal protein levels did tend to be positively correlated with cancer incidence, as one should expect of the experiments in rats and mice were an indication of what happens for human beings. (One thing to keep in mind is that this "China Study," by looking at all reported cancers within a county was sensitive to differences in cancer incidence of modest size. Nevertheless, if the correlations are actually indicative of causal effects as in the mice and rat experiments, the effects are much larger than cancer dangers that get hyped a great deal.)

How much animal protein is too much? Experimentally, in the mice and rates the comparison was between something like 5% of calories as animal protein and 20%. Despite starting out in life as an enthusiastic meat, milk and egg eater, Colin Campbell wants everyone to go vegan, but I am not ready to go there, both because

I enjoy animal-based food, and

I am not 100% sure a level of complete protein equal to zero is fully safe—and to the extent a vegan diet provides a full set of amino acids it might have the same downsides as an animal protein diet by providing great nutrition for cancer cells.

What I am willing to do personally, is to try to keep animal protein down to 1 calorie per day per pound of body weight, or a number of grams of protein equal to one quarter of my weight in pounds. How do I come up with that as a helpful target? In Chapter 16 of The China Study, "Government: Is It for the People," Colin writes:

Relative to total calorie intake, only 5–6% dietary protein is required to replace the protein regularly excreted by the body (as amino acids). About 9–10% protein, however, is the amount that has been recommended for the past fifty years to be assured that most people at least get their 5–6% “requirement.” This 9–10% recommendation is equivalent to the well-known RDA.

I am thinking of a target of around 7% of calories in animal protein on a typical day, without trying to count up the amount of plant protein. Then the complete animal protein alone would be enough to replace the amino acids that are used up and depleted, with plant protein as extra. The footnote at the end of Colin's passage suggests that 2200 calories a day would be typical for someone weighing 70 kilograms. Since a kilogram is about 2.2 pounds, proportionally that is 2200 calories/(2.2 * 70 kilograms) per day= (100/7) (calories/pound) per day. 7% of that is 1 calorie per pound per day. A gram of protein has about 4 calories, so 1 calorie of animal protein per pound of body weight per day is about 1/4 of a gram of animal protein per pound of body weight per day.

I found by trying it out that for generic animal foods, you can google "how many grams of protein does [animal food x] have" and get a ready answer (with the specification of a measure of weight nice but often optional). For less generic animal foods—for example mozzarella cheese of a particular brand—one can look on the package. To provide some idea of magnitudes, a large egg has about 6 grams of protein, a cup of milk has 7.7 grams of protein, while a quarter-pound hamburger patty has about 29 grams of protein.

Although I think Colin Campbell and his coauthors provide some important data on a possible relationship between animal protein consumption and cancer, I don't think Colin reads the full range of evidence appropriately in coming to his overall viewpoint.

In particular, given the evidence he has to worry about animal protein (by my hypothesis, because of its completeness), there is no evidence to speak of against animal fat. Any worrisome correlation that seems to make animal fat suspect could easily be due to negative effects of the animal protein that tends to go along with animal fat. And the US and other advanced countries have done a massive experiment of trying to improve health by subtracting fat—mostly animal fat—from food products. That subtraction of animal fat has done nothing to improve health, as large studies such as the Women's Health Study have indicated. Colin Campbell talks about interactions among the components of whole foods being the key, but only the nutritional interaction among the amino acids in animal proteins is necessary to explain things. Subtracting animal fat doesn't do any good because it is the animal protein that is the problem, not the animal fat!

For more on dietary fat, see "Jason Fung: Dietary Fat is Innocent of the Charges Leveled Against It."

Also, I am quite skeptical of Colin Campbell's view that animal protein is key to the main axis of "Western Diseases." The reason I am skeptical is that most "Western Diseases" or "diseases of affluence" are correlated with obesity, and there is reason to think that, to a first approximation, "Obesity Is Always and Everywhere an Insulin Phenomenon." Disregulation of the insulin system has to do with things that cause insulin to spike. In "Obesity Is Always and Everywhere an Insulin Phenomenon" I give a rule of thumb that a Food Insulin Index over 40 is high. Sugar and refined carbs typically exceed that level of 40 by quite a bit. Animal foods, not so much. Let me reproduce my animal food selections from a food insulin index table that I gave in Obesity Is Always and Everywhere an Insulin Phenomenon" here:

Meat and Eggs

eggs (poached) 23± 8

steak 37 ± 24

skinless roast chicken 17± 8

white fish 43± 26

hot dog 16± 6

bacon 9± 4

tuna packed in water 26± 8

tuna packed in oil (drained) 16± 4

Dairy

strawberry lowfat yogurt . 64 ± 12

skim milk 60 ± 26

1% milk 34 ± 8

whole milk 24 ± 6

cream cheese 18 ± 12

butter 2 ± 2

Skim milk and lowfat yogurt look bad, and whitefish is a little high, but it doesn't look like most animal foods cause big insulin spikes.

In other words, meat, dairy and eggs, by providing an abundance of complete proteins may help build strong cancer cells, but there is no good evidence that they make people fat. And if meat, dairy and eggs don't make you fat, the variance of cancer they would be available to help explain would be the (still substantial) variance of cancer that is not explained by variance in obesity. Statistically, I would be especially interested in multiple regressions of cancer on obesity and animal protein consumption (with measurement error correction for obesity to make sure that one wasn't undercontrolling for obesity).

As I mentioned above, personally, I am convinced enough by the evidence to marginally cut back on my animal protein consumption. If I were diagnosed with cancer, I would cut back further. There are some extra issues with dairy proteins that Colin Campbell points to that worry me some—grist for a future post. There is no evidence whatsoever to convince me to reduce my animal fat or plant fat consumption.

Despite disagreements, it is important to point to areas of agreement. Colin Campbell, Gary Taubes and Jason Fung all argue quite strongly that sugar and refined carbs are very bad. You should cut them out of your diet.

Everyone agrees that non-starchy vegetables are great. Because fruit has both sugar (bad) and antioxidants + other valuable phytochemicals (good), Colin Campbell and Gary Taubes differ on how much fruit to eat. But everyone agrees that whole fruits are much healthier than fruit juice. (The fiber in the whole fruit slows down the digestion of the sugar to moderate the insulin spike.)

More research is needed to definitely answer the key questions. Unfortunately, much of the research effort in the last few decades has been barking up the wrong tree, thinking that fat in general, or animal fat in particular, was a key dietary villain. In my view, research should focus on (a) "How much can be explained by insulin levels?" and (b) "Controlling for insulin levels, what are the effects of animal protein (or complete sets of amino acids)?" If there are some baleful effects, then I would want to know "Is there some level of animal protein consumption that is safe?" I also want to know whether infrequent (say once a week or once every other week) high levels of animal protein from going out to a restaurant are dangerous or not. The part of this question that relates to my hypothesis is the question of if cancer growth depends on a regular superabundance of complete protein or (as I hope is not so) if cancer growth can proceed vigorously even with only an occasional superabundance of complete protein.

In "Obesity Is Always and Everywhere an Insulin Phenomenon," I make the analogy that trying to lose weight without skipping meals is like trying to reduce inflation without a recession. Given the crucial importance of combining a low-refined-carb diet with fasting for weight loss and maintaining a lower weight, research should focus on (c) investigating the effects of fasting. The direct effect of fasting is to lower insulin levels. But "How often can fasting lower insulin resistance?" And "To what extent can relatively frequent 18-20 hour fasts or 42-44 hour fasts mitigate any baleful effects of animal proteins that might be discovered under research agenda (b)?"

Don’t miss my other posts on diet and health:

I. The Basics

Jason Fung's Single Best Weight Loss Tip: Don't Eat All the Time

What Steven Gundry's Book 'The Plant Paradox' Adds to the Principles of a Low-Insulin-Index Diet

David Ludwig: It Takes Time to Adapt to a Lowcarb, Highfat Diet

II. Sugar as a Slow Poison

Best Health Guide: 10 Surprising Changes When You Quit Sugar

Heidi Turner, Michael Schwartz and Kristen Domonell on How Bad Sugar Is

Michael Lowe and Heidi Mitchell: Is Getting ‘Hangry’ Actually a Thing?

III. Anti-Cancer Eating

How Fasting Can Starve Cancer Cells, While Leaving Normal Cells Unharmed

Meat Is Amazingly Nutritious—But Is It Amazingly Nutritious for Cancer Cells, Too?

IV. Eating Tips

Using the Glycemic Index as a Supplement to the Insulin Index

Putting the Perspective from Jason Fung's "The Obesity Code" into Practice

Which Nonsugar Sweeteners are OK? An Insulin-Index Perspective

V. Calories In/Calories Out

VI. Other Health Issues

VII. Wonkish

Framingham State Food Study: Lowcarb Diets Make Us Burn More Calories

Anthony Komaroff: The Microbiome and Risk for Obesity and Diabetes

Don't Tar Fasting by those of Normal or High Weight with the Brush of Anorexia

Carola Binder: The Obesity Code and Economists as General Practitioners

After Gastric Bypass Surgery, Insulin Goes Down Before Weight Loss has Time to Happen

A Low-Glycemic-Index Vegan Diet as a Moderately-Low-Insulin-Index Diet

Analogies Between Economic Models and the Biology of Obesity

Layne Norton Discusses the Stephan Guyenet vs. Gary Taubes Debate (a Debate on Joe Rogan’s Podcast)

VIII. Debates about Particular Foods and about Exercise

Jason Fung: Dietary Fat is Innocent of the Charges Leveled Against It

Faye Flam: The Taboo on Dietary Fat is Grounded More in Puritanism than Science

Confirmation Bias in the Interpretation of New Evidence on Salt

Eggs May Be a Type of Food You Should Eat Sparingly, But Don't Blame Cholesterol Yet

Julia Belluz and Javier Zarracina: Why You'll Be Disappointed If You Are Exercising to Lose Weight, Explained with 60+ Studies (my retitling of the article this links to)

IX. Gary Taubes

X. Twitter Discussions

Putting the Perspective from Jason Fung's "The Obesity Code" into Practice

'Forget Calorie Counting. It's the Insulin Index, Stupid' in a Few Tweets

Debating 'Forget Calorie Counting; It's the Insulin Index, Stupid'

Analogies Between Economic Models and the Biology of Obesity

XI. On My Interest in Diet and Health

See the last section of "Five Books That Have Changed My Life" and the podcast "Miles Kimball Explains to Tracy Alloway and Joe Weisenthal Why Losing Weight Is Like Defeating Inflation." If you want to know how I got interested in diet and health and fighting obesity and a little more about my own experience with weight gain and weight loss, see “Diana Kimball: Listening Creates Possibilities” and my post "A Barycentric Autobiography. I defend the ability of economists like me to make a contribution to understanding diet and health in “On the Epistemology of Diet and Health: Miles Refuses to `Stay in His Lane’.”

Private Property Reduces Decision-Making Costs

For some people, there is a certain glow to democratic decision-making. And once obtained, there can be no objection to explicit universal consent. But democratic decision-making, and getting explicit universal consent can be very costly.

For example, the high level of democracy for decision-making by the tenure-track faculty at the University of Michigan is one case in point in my own life. This required a lot of time in faculty meetings. Fewer decisions are explicitly democratic at in the Economics Department at the University of Colorado Boulder where I am now, but the quality and degree of consensus in decision-making is nevertheless high here.

Dividing up goods held in common into private property for individuals is a way to dramatically reduce the amount of costly democratic, or more generally political, decision-making that is required. In section 29 of his 2d Treatise on Government: “Of Civil Government” (Chapter V "Of Property"), John Locke points to this as an advantage of the kind of "labor theory of property" he thinks appropriate to the state of nature:

By making an explicit consent of every commoner necessary to any one’s appropriating to himself any part of what is given in common, children or servants could not cut the meat, which their father or master had provided for them in common, without assigning to every one his peculiar part. Though the water running in the fountain be every one’s, yet who can doubt but that in the pitcher is his only who drew it out? His labour hath taken it out of the hands of nature, where it was common, and belonged equally to all her children, and hath thereby appropriated it to himself.

One doesn't have to accept John Locke's labor theory of property in order to see a benefit of some method of dividing things not yet divided up and making them private property.

When I say this, I am thinking of goods that are rivalrous in consumption. The argument for making private property of goods that are nonrivalrous—that everyone could simultaneously enjoy—is much weaker. There the rule that everyone gets to benefit from the good is a very attractive one; society should be slow, careful and limited in ever making nonrivalrous goods private property.

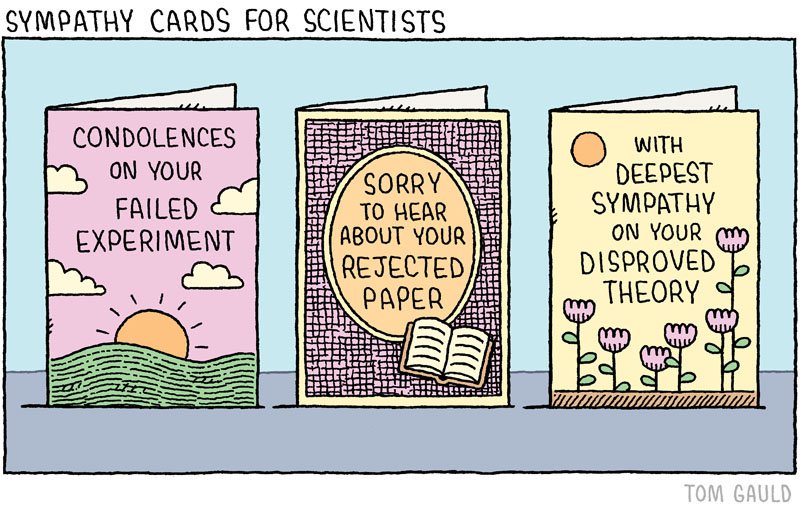

Tom Gauld's Sympathy Cards for Scientists

A rejected paper is always painful. But if you have a failed experiment experiment or a disproved theory there is always the silver lining that you have learned something you didn't expect. A good scientist should care more about finding out the truth than about having been right. A failed experiment or disproved theory is one step closer to the truth.

The key to taking this attitude is to bring out one's curiosity. See "Tim Harford: Facts Without Curiosity are Dead."

This year, I have written many posts touching on being human, on being a scientist and on being an economist. Here are the main ones:

- Believe in Yourself

- Breaking the Chains

- Leaving a Legacy

- My Objective Function

- The Unmaking

- John Locke on the Mandate of Heaven

- Economics Needs to Tackle All of the Big Questions in the Social Sciences

- Defining Economics

- Does the Journal System Distort Scientific Research?

- Let's Set Half a Percent as the Standard for Statistical Significance

Some Selections Related to Negative Interest Rate Policy from the General Discussions at the 2016 Jackson Hole Symposium on "Designing Resilient Monetary Policy Frameworks for the Future"

I was honored to be invited to the 2016 Jackson Hole Monetary Policy Symposium. At the time, I tweeted

At Jackson Hole I am like a kid in a candy shop. Lunch with Ben Bernanke and the very impressive Haruhiko Kuroda. Hike with John C. Williams.

I participated actively in the general discussion after each paper. The most remarkable paper was Marvin Goodfriend's paper "The Case for Unencumbering Interest Rate Policy at the Zero Bound," which I highly recommend. Let me give you some excerpts from those discussions.

On "The Case for Unencumbering Interest Rate Policy at the Zero Bound" by Marvin Goodfriend

Miles Kimball: I think this is a very interesting discussion. I think there’s an important message here which is that already any central bank that has a little political running room should set interest rates as if there is no lower bound because it is actually quite easy to eliminate the zero lower bound. On the particular approach to eliminate the zero lower bound, Ruchir Agarwal and I have an IMF working paper, “Breaking Through the Zero Lower Bound,” that argues that a crawling peg can be implemented and defended very, very smoothly, contrary to what Marvin Goodfriend said. I also want to say that it’s a big deal for anyone to do the deep negative rates because any central bank using deep negative rates even once would avoid the downward pressure on long-term rates from markets thinking falsely that central banks might run out of ammunition. And so it would be a great, good turn for the world if any central bank implements deep negative rates just to demonstrate that there is plenty of monetary policy ammunition no matter what we face. There’s also another big benefit of being able to use deep negative rates that you can have quicker closing of output gaps. The last thing I want to say is in terms of the politics, I think the issues of bank profits can easily be dealt with by a lot of mechanisms and it’s also very easy for central banks to subsidize the provision of zero rates to small household accounts, by just using the interest on reserve formulas. So that’s a proposal I’ve made which I think can very much improve the politics of negative interest rates.

Marvin Goodfriend: Let me reiterate that a main point of my paper is that central banks don’t have a choice about long-term real interest rates. Long-term rates are governed largely by real forces outside the purview of monetary policy. Rather, central bank interest rate policy must accommodate long-term rates in order to sustain a low targeted rate of inflation. Monetary policy is about managing short-term interest rates. Short-term nominal interest rates have had to fall a few percentage points below long-term nominal bond rates in the United States to stimulate the recovery from each of the eight recessions we’ve had since 1960. If inflation and inflation expectations are stabilized at a 2 percent target and real bond rates remain non-negative as seems reasonable, then nominal bond rates should remain somewhat positive. In that case, deeply-negative short-term nominal interest rates may not be needed except perhaps temporarily to stimulate the recovery from recession. In large part, short-term interest rate policy stimulus works by coordinating an increase in spending, first to help offset contractionary dynamics and then to help initiate a cyclical expansion. If employed promptly and decisively against recession, interest rate policy would not likely sustain deeply negative nominal short-term interest rates for very long. I agree it’s not popular for central banks to say they might make short-term interest rates negative, even temporarily. That’s why I wrote the paper from the perspective of monetary history. It wasn’t popular when central banks left the gold standard. It wasn’t popular when fixed exchange rates were abandoned. Even though there were good reasons to do so. It took a long time for the public to get comfortable with a flexible money price of gold and later with flexible foreign exchange rates. Taking a longer-run perspective, it’s taken hundreds of years for the world to accept flexibility in relative prices as necessary to allocate goods and services to their most valued uses in society. Thomas Aquinas, notably among a host of other thinkers, thought of prices largely in terms of fairness rather than allocative efficiency. The real intertemporal terms of trade is one of the most controversial relative prices in this regard. This is so in part because of the widespread misapprehension that central banks are free to choose interest rate policy as they see fit, which tends to perpetuate the erroneous view in some quarters that interest rate policy is a matter of balancing fairness and allocative efficiency. Let me come to the comment about Argentina. It’s been a great laboratory and I’d like to hear more about that. On Miles Kimball’s point, we both recognize the feasibility and desirability of negative interest rate policy, and have said so in our own ways in the past. The point I’m emphasizing in my paper today is that interest rate policy can and should be unencumbered expeditiously in a future crisis so that negative nominal interest rates can be made freely available and fully effective as realistic policy option. Kristin Forbes raised an important concern about insurance companies and pension funds. In the past, insurance and pension services have been bundled with promises of significant positive returns. They’ve been bundled saying, “We will promise you a high long-term yield and we will also provide you insurance.” The bundled promised return will not be viable in a low-interest world. However, that is not a problem for monetary policy; it’s a problem for business practice.

[Everyone had the chance to edit their remarks. Unedited, what Marvin said in response to my comment was

On Miles Kimball’s point, you know Miles and I are allies on this, and I’d like to talk to him about the crawling peg and the feasibility. Maybe I’m wrong, I don’t know. But basically we’re in the same camp as this is something that should happen and can happen.]

On "Evaluating Alternative Monetary Frameworks," by Ulrich Bindseil

From Jean-Pierre Danthine's Discussion (see also his post and paper "The Interest Rate Unbound"):

I start from the observation that commercial banks have universally been very reluctant to pass on negative rates to their retail clients. This reluctance can be understood as the result of two facts. First, retail clients have been forever the prime source of low-cost funding for banks and thus key to the profitability of their maturity transformation operations. Second and importantly, negative interest rates are very unpopular. They are counterintuitive for the man in the street and generally seen as a measure of financial repression. In this context, bankers are understandably fearful that imposing negative rates at the retail levels will lead to the permanent loss of their prized retail clientele. And it is a fact that retail depositors have not been affected by this monetary policy measure (except in the form of higher banking fees) in any of the five economic areas with negative policy rates. With this configuration, paper currency hoarding by the general population is not a threat and preventing hoarding at the wholesale level should be enough to permit a significant lowering of the effective lower bound (ELB). To achieve that outcome, a modest design add-on should do: the ability to impose a fee on paper currency withdrawal at the wholesale level. The fee structure should be independent of handling costs so that it can be tailored to the depth of negative rates and the anticipated duration of such a regime. It would be exclusively preventive with the goal of making paper currency hoarding unprofitable (thus the fee would never be levied). It is true that, the lower the rate, the larger the pressure on the profitability of the banking system given the fact that market rates are affected by the policy measure. To a large extent this pressure can be alleviated by an OF innovation mentioned by Bindseil, the excess reserves tiering systems, by which the bulk of excess reserves is exempted from the application of negative rates. The Swiss experience is conclusive on this score: bank profitability has been maintained in 2015 (it has actually improved) despite the introduction of negative rates in mid-January. This is not Commentary 285 to say that the current environment is not challenging for banks (or for that matter other financial institutions such as pension funds and wealth managers) but this has more to do with low rates on all assets than with negative rates on cash per se. This “minimal” way of lowering the ELB has one big advantage: with the retail depositors not affected by the negative rates, public acceptance of the policy stands a much better chance (even if it is not straightforward). It also has its drawback, in particular, it will not be effective if the objective of the policy is to provide a “classical” monetary stimulus in a bank dominated financial system. In Switzerland, bank lending rates have been only marginally affected by the negative rate policy and mortgage rates have actually increased after the introduction of negative rates. For a small open economy in search of an appropriate interest rate differential to moderate the strength of its currency, however, the exclusive transmission of negative rates to market instruments is sufficient and such a way of lowering the ELB would be of great help.

Miles Kimball: I just wanted to highlight Jean-Pierre Danthine’s remark about the ability to attain medium low rates, say minus 200 basis points even without taking paper currency off par. In particular, by encouraging zero rates for households (in ways I would add that don’t hurt the bank profits too much) you can subsidize that through the interest on reserve formula, and then you can make the wholesale storage of paper currency difficult. There was a very, very interesting Brookings conference on negative rates on June 6 that has the videos all online where these kinds of issues were discussed very nicely.

On Chris Sims's Lunch Talk: "Fiscal Policy, Monetary Policy and Central Bank Independence."

[There is no transcript of this discussion, but I report on my question and Chris Sims's answer in my post "Negative Rates and the Fiscal Theory of the Price Level."}

On "Central Bank Balance Sheets and Financial Stability" by Robin Greenwood, Samuel Hanson and Jeremy Stein

Miles Kimball: I want to say first that this is a brilliant paper, discussion and presentation. I think this is an excellent idea. I wanted to say I think this overnight reverse repurchase agreement (RRP) program is important for a very large number of reasons. I want to talk about it in relation to having in your quiver things that will help you with negative interest rate policy. First, it’s something that helps reinforce the electronic unit of account. The second thing that’s good about the RRP is that you can probably legally have negative interest on reserves, but you don’t even have to do that because you can cap the reserves at slightly above required reserves and then just use the RRP program for the same function that you would have used interest on reserves and have that go negative. Then the final thing relates to this problem of people moving to the RRP; I think the right answer is you just drop the interest rate on RRP very, very fast, along with the fed funds rate when you do get into that crisis.

[Jeremy Stein made no direct response to my comment. My post the following Monday, "How the Fed Could Use Capped Reserves and a Negative Reverse Repo Rate Instead of Negative Interest on Reserves" elaborated on my point.]

On "Funding Quantitative Easing to Target Inflation," by Ricardo Reis

Miles Kimball: This is a question for both of you [Ricardo Reis and discussant Laura Veldkamp] because you’ve questioned some of the channels through which QE might affect the economy. Yesterday, Chair Yellen showed a chart where the combination of QE and forward guidance could do almost as well as lowering interest rates by 400 basis points. Given your read on QE being a little different, but adding in the forward guidance, do you think that assessment of how well QE and forward guidance alone without deeper interest rate cuts could stabilize the economy is realistic?

Ricardo Reis: On Miles Kimball’s question, the point that I am making is that in spite of all of the richness in asset purchases and all the diversity of assets in the balance sheet, in spite of this being perhaps a new world where the market for reserves is saturated, I am making a strong claim that we are back to normal in the sense that it is interest rate policy that controls inflation. Whether interest rates are negative or positive, whether they follow rules or using discretion, whether that is with more forward guidance or less forward guidance, we have a long literature and history of thinking about these issues. I am arguing that we should discuss interest rate policy as the primary way to control inflation.

Laura Veldkamp: I was going to respond to what Miles Kimball said. Yes, I believe in forward guidance. I think that that is an effective tool for controlling expectations, but I don’t think that that eliminates the fear of tail risk. I’m not sure what in those scatterplots would lead us to believe a financial crisis is not possible.

On Haruhiko Kuroda's handout in the Overview Panel: "Re-Anchoring Inflation Expectations via ‘Quantitative and Qualitative Monetary Easing with a Negative Interest Rate’"

Miles Kimball: So, I think there’s an explanation for Chart 4 that Governor Kuroda showed about the JGB yield curve coming down, that Massimo Rostagno talked about at the Brookings conference in June. And that’s if people think interest rates can only go up from zero, then out in the future, you’re going to have the yield curve go up more. And so I think it’s hugely valuable when you bring down market expectations about the effective lower bound. And Massimo argued that that was very complementary with a quantitative easing policy.

Haruhiko Kuroda: .... you can look at the last chart, JBG yield curve, the highest one is the yield curve just before we introduced QQE. The middle curve 542 Chair: Kristin J. Forbes is the yield curve just before we introduced the negative interest rate. So, almost three years of substantial QQE, yes, reduced the nominal interest rate, but to this extent. And actually in this period, more important was real interest rate decline caused by increased inflation expectations. That was the sort of first year and a half or something like that. And then, the lowest yield curve shows the yield curve at this moment. This shows that negative interest rate of minus 0.1 percent on a marginal amount of deposits caused a substantial decline of the yield curve. The short end declined by 20 basis points. We reduced interest rates by 20 basis points at the short end. But the long end, it showed a quite substantial decline of interest rates. So, I agree with you that negative interest rate policy sort of unleashed the impact of our QQE subdued up until January 2016.

Darrin McMahon: For Most of History, People Didn't Assume They Deserved to Be Happy. What Changed? →

When I first read this, I noticed "sponsored content" (now moved) next to it that was also interesting: "Making your money count toward your happiness" from Prudential.

John Roberts on the Roots of Empathy and Compassion

From time to time in the years to come, I hope you will be treated unfairly, so that you will come to know the value of justice. I hope that you will suffer betrayal because that will teach you the importance of loyalty. Sorry to say, but I hope you will be lonely from time to time so that you don’t take friends for granted. I wish you bad luck, again, from time to time so that you will be conscious of the role of chance in life and understand that your success is not completely deserved and that the failure of others is not completely deserved either. And when you lose, as you will from time to time, I hope every now and then, your opponent will gloat over your failure. It is a way for you to understand the importance of sportsmanship. I hope you’ll be ignored so you know the importance of listening to others, and I hope you will have just enough pain to learn compassion. Whether I wish these things or not, they’re going to happen. And whether you benefit from them or not will depend upon your ability to see the message in your misfortunes.

Jordan B. Peterson on the True Purpose of a University Education

Link to the video above on YouTube

Hardhitting and inspiring!